401k Contribution 2025 Limit. After rising substantially from $20,500 in 2022 to $22,500 for 2025, mercer projects the annual cap to go up just $500 in 2025. The big list of 401k faqs for 2020 workest, for 2025, the employee contribution limit for 401 (k) plans is $23,000, up from $22,500 in 2025.

The big list of 401k faqs for 2020 workest, for 2025, the employee contribution limit for 401 (k) plans is $23,000, up from $22,500 in 2025. Those 50 or older can contribute up to $30,000.

In 2025, the contribution limit for a roth 401(k) is $23,000, plus an additional contribution of $7,500 if you are age 50 or older.

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, Employees can invest more money into 401 (k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025. Maximum 401(k) contribution limits for 2025 total 401(k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025.

401k And Roth Ira Contribution Limits 2025 Cammy Caressa, The 2025 401(k) contribution limit is $500 higher than this year’s $22,500 max, which reflected a major increase from the 2022 limit of $20,500. In 2025, the contribution limit for a roth 401(k) is $23,000, plus an additional contribution of $7,500 if you are age 50 or older.

401k Contribution Chart, The 2025 401(k) contribution limit is $500 higher than this year’s $22,500 max, which reflected a major increase from the 2022 limit of $20,500. Maximum 401(k) contribution limits for 2025 total 401(k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025.

Significant HSA Contribution Limit Increase for 2025, Those 50 or older can contribute up to $30,000. The 2025 401(k) contribution limit is $500 higher than this year’s $22,500 max, which reflected a major increase from the 2022 limit of $20,500.

401(k) Contribution Limits in 2025 Meld Financial, 2025 401(k) and 403(b) employee contribution limit. The 2025 401(k) contribution limit is $22,500.

40 Passive Revenue Concepts For 2025 To Construct Actual Wealth, After rising substantially from $20,500 in 2022 to $22,500 for 2025, mercer projects the annual cap to go up just $500 in 2025. The 401 (k) overall contribution limit.

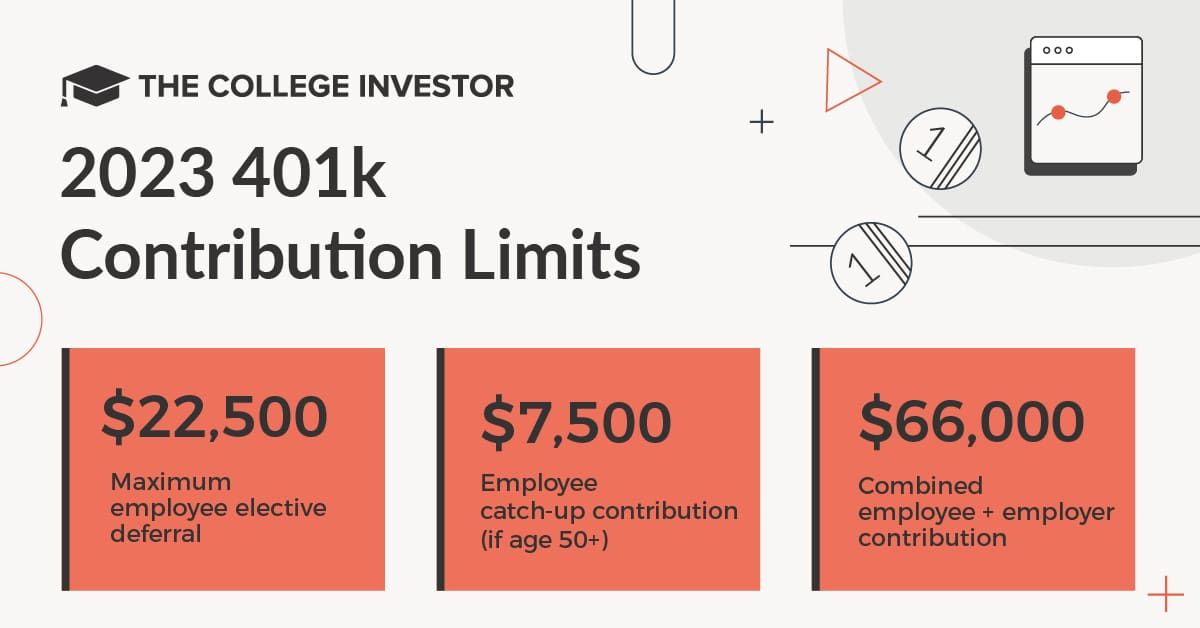

How The SECURE Act Changes Your Retirement Planning The Ugly Budget, For 2025, the overall annual contribution limit (including both individual and employer contributions) was $66,000; Employees can invest more money into 401 (k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025.

The IRS just announced the 2022 401(k) and IRA contribution limits, What are the 2025 contribution limits? The 401 (k) overall contribution limit.

What Is The 401k Limit For 2025 Over 50 Lexi Shayne, In 2025, the 401 (k) contribution limit for participants is increasing to. The limit on employer and employee contributions is $69,000.

What Is The 401k Limit For 2025 Over 50 Lexi Shayne, The 2025 401(k) contribution limit is $500 higher than this year’s $22,500 max, which reflected a major increase from the 2022 limit of $20,500. In 2025, the aggregate annual limit is 100% of your compensation or $69,000 for taxpayers under age 50 ($76,500 if you're older than that).